|

A British Airways flight attendant helps "pandas" get ready for the new route between London and Chengdu, at London Heathrow Airport in June. International carriers started more than a dozen new routes to China's second and third-tier cities in the past two years. Provided to China Daily |

Meeting and capitalizing on the surge in demand for air travel to china presents a complex flight plan for international carriers

As demand for long-haul flights between China and the rest of the world continues to rise, international air carriers are grappling with how they can increase destinations beyond the country's major transportation hubs.

Fueled by the migration of international businesses to cities beyond the big three - Beijing, Shanghai and Guangzhou - carriers are busy mapping out new routes to facilitate business and leisure travel.

"For a majority of the international carriers, if they want to expand in China, they will have to look beyond the standard places used in the past," says Andrew Herdman, director-general of the Association of Asia-Pacific Airlines.

In the past two years, more than a dozen new routes to second and third-tier cities have been introduced by the biggest international airlines.

Most recently, British Airways set up a service flying three times a week from London to Chengdu, capital of Southwest China's Sichuan province, the first new route for the UK airline in China in seven years.

It plans to increase the service to five times a week this summer, using one of the company's new four Boeing Dreamliner aircraft.

Qatar Airways also announced a new service to Chengdu in September, targeting the city that serves as one of the centers in the Chinese government's go-west campaign, urging businesses to move from saturated coastal areas.

In June 2013, Finnair started a direct flight three times a week from Helsinki to Xi'an, capital of Shaanxi province and home to the Terracotta Warriors.

The nation's oldest international air partner, Lufthansa, which first began flights to China in 1926, was again one of the first to seek out second-tier cities as destinations, establishing routes to Shenyang, capital of the northeastern province of Liaoning, and Qingdao in East China's Shandong province, as early as the summer of 2012.

"As a global airline, we want to grow with the market and we operate flights where we see a substantial demand and future potential. We constantly evaluate our network," says Juerg Christen, Lufthansa's managing director for Greater China.

The long list of new routes from international carriers in China marks a potential shift in how the market is perceived.

Historically, international carriers would connect with the major airports of a country and establish local partnerships to help carry passengers to less frequently traveled destinations.

"The lesson from history is to focus on particular points and serve it with regular frequency, establish good distribution, use alliance partnership or code-shares with industry partners to build a feed to and from," Herdman says.

But with China set to be one of the fastest growing markets in terms of passenger numbers, relying on local alliances may not be enough if international carriers want to tap into the country's potential.

"The foreign carriers are taking a different view," Herdman says. "They recognize they might not be able to get more slots in Beijing, Shanghai or Guangzhou, so they are becoming more tempted to put in direct services to cities like Chengdu and others."

Hesitating to call any city second-tier, Herdman says cities such as Chengdu, Qingdao and Chongqing are among the most populated on the globe.

According to the Airline Industry Forecast published by the International Air Travel Association in December, China's passenger numbers are expected to jump by 227.4 million by 2017 on routes within or connected to China.

The report places China as the largest driver of growth, accounting for 24 percent of new passengers over the next three years.

Of the new passengers, 195 million are expected to be domestic travelers, with 32.4 million international.

International passenger volume within China is expected to continue thriving with a 7.1 percent compound annual growth rate.

The Middle East, with a healthy 6.3 percent compound annual growth rate, holds the strongest growth by region.

Connecting the two busiest regions, Qatar Airlines launched its Hangzhou-Doha route last month.

"The fact that the Asia-Pacific region, led by China, and the Middle East, will deliver the strongest growth over the forecast period is not surprising," says Tony Tyler, director general and CEO of IATA.

"Governments in both areas recognize the value of the connectivity provided by aviation to drive global trade and development.

"To reap the benefit, governments in those regions will need to change their view of aviation from a luxury cash cow to a utilitarian, powerful draft horse to pull the economy forward."

But it's not just business travelers seeking opportunity in the untouched corners of the world's second-largest economy who are calling for more international flights.

Increased interest in travel abroad from China's prospering middle-class has the airlines deliberating over how to take advantage of this new generation of vacationers.

In 2012, outbound travelers from China were more than 80 million, prompting several European tourist boards to launch campaigns to draw in Chinese tourist pounds and euros. The number hit 97 million last year.

Many of these travelers were from cities outside of Beijing and Shanghai. It is in the second-tier cities where the real swelling of numbers is taking place.

At the Zhengzhou international airport in the capital of Henan province, a city most recognized in the West as a production center for Apple products, growth in passenger rates is almost double the national average, hitting 13 percent in 2012.

"It is definitively an asset to have direct flights into second-tier cities with a strong demand, and it makes our global network even stronger," Christen of Lufthansa says. "It allows the passenger to fly directly to and from Europe without having to change aircraft."

Despite an eagerness to explore the untapped potential of China's more remote regions, many airlines are expressing caution about starting new routes.

Establishing a flight to a new city is a multi-million-dollar gamble. A standard route operating with a Boeing 767, which can carry 220 passengers, can cost an airline up to $50 million (37 million euros) per year to operate, requiring more than 120,000 passengers per year to break even.

That price tag is slightly lower for international carriers traveling to second-tier cities, with many local governments offering subsidies to airlines to establish international routes to help bring investment and tourism to the city.

In 2012, more than 600 million yuan ($99 million; 73 million) in subsidies were offered by 18 Chinese cities to airlines willing to establish international routes.

And while subsidies may offer a head start for a new flight path, when the funding stops, airlines are occasionally left with a tough decision - fold the flight or risk running into the red.

This was the choice Air France faced early last year. After running its Paris-Wuhan route for two years, the carrier decided to reduce its frequency from three times a week to two, after considering canceling the flight altogether.

According to one French newspaper, Air France was being offered about 30,000 euros per flight by the local government to the capital of Central China's Hubei province.

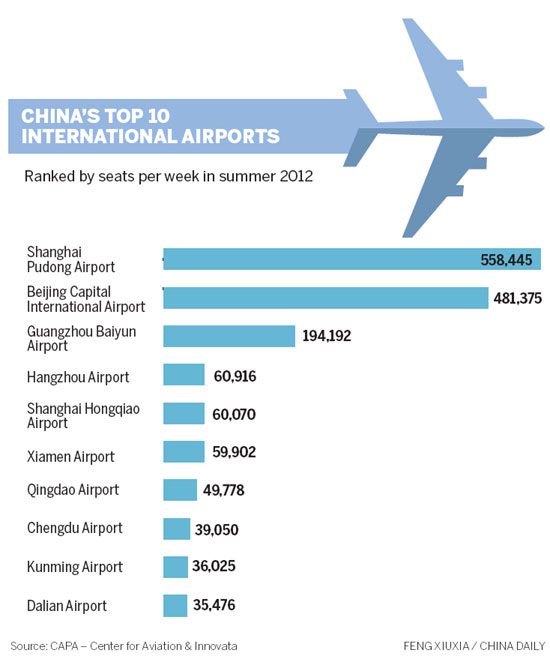

Though many airlines are eager to expand, China's current air regulations and infrastructure are already feeling the strain. Beijing Capital International Airport, which opened its third terminal in 2008 for the Beijing Olympics, is the second-busiest airport in the world, handling 82 million passengers per year. The busiest, Hartsfield-Jackson International Airport in Atlanta, Georgia, sees 95 million passengers annually.

Shanghai Pudong and Hongqiao airports are not far behind, handling a combined 80 million passengers last year, according to reports from the Center for Asia-Pacific Aviation.

Guangzhou Baiyun International Airport expects to handle 52 million passengers this year, compared with just 20 million when the airport opened in 2004.

Combined, these three cities account for 31 percent of the total air traffic in China.

While airports and airlines generally welcome high passenger numbers, coordinating such traffic often comes with a host of problems, largely resulting in unexpected flight delays.

Chinese airports, despite being among the busiest in Asia, failed to take any of the top 10 spots in the 2013 On-time Airline and Airport Performance report, published by Flightstats.

"What is disturbing are the delays on the ground, just before take off," says Peter Jorna, president of the European Association for Aviation Psychology. "I know this for Shanghai where we often have to wait three hours in the aircraft, before starting a flight of 12 to 13 hours.

"Such long hours are not OK for both crew and passengers."

Aiming to divert traffic away from such high-volume areas to alleviate pressure and avoid delay, China has seen several new airports built in second and third-tier cities in the past decade.

Most recently, the southern city of Shenzhen completed work on an 8.5 billion-yuan international terminal in November. Triple the size of the airport's other terminals, it saw a staggering 2 million passengers pass through its gates within the first month of operation.

Chengdu, which has seen the most new activity from international airlines, plans to build a new airport by 2017 that will double the current capacity of the present one.

Beijing will also see an additional $11.8 billion airport with seven runways built in the southern part of the city, due to be completed by 2018.

"China is investing in ground infrastructure," says Zhang Baojian, regional vice-president of IATA North Asia. "By 2015, China is expected to have more than 230 airports. This will ensure that there is sufficient capacity to accommodate the anticipated aviation growth.

"However, investing only in infrastructure on the ground will not be enough. By 2020, the anticipated traffic volume is expected to result in flight delays at Chinese airports if the airspace structure remains unchanged from today. This means flights will not be able to depart or arrive on time."

The sheer speed of growth means that even as new airports are built, they are serving only to keep up with the current amount of passengers, Herdman of the AAPA says.

"You can build airplanes and fly them but if the airspace management and airport capacity doesn't keep pace, then you are going to get problems, and that's felt by the traveling public in terms of delays and congestion," he says.

"But even where there is an enthusiasm for building modern infrastructure, you can point to a number of cases where it hasn't kept pace with demand.

"We're talking about China, but there's a similar case in the Philippines and Indonesia, where the rapid growth in demand for air travel, particularly domestic, has outstripped the runway and terminal capacity."

Compounding congestion is China's unique management of airspace. As is the case with the development of most commercial aviation zones worldwide, Chinese airspace began under military control. But unlike in other parts of the world, where airspace control was gradually ceded as the aviation industry grew, in China more than 80 percent of airspace still remains under the control of the military.

This places a limit on the amount of flights allowed to a certain location, even if the infrastructure is capable of supporting more.

Limited airspace has led to strong competition among domestic and international airlines vying for slots at the major hubs. With a majority of the new passengers in China traveling domestic, when slots do become available at major hubs, they are often awarded to local carriers.

The tough competition with domestic carriers at the major city hubs has further prompted international carriers to look to routes where terminal spaces are more easily accessed and new markets can be created.

For US carriers, it's not just airspace limiting the flow of flights between the US and China, says Robert Mann, CEO of R.W. Mann and Company Inc, a US-based aviation analysis and consulting firm.

He says the lack of bilateral agreements between China and the US have created a hesitation from US carriers about investing too much into expanding their China business.

"The primary issue for US airlines is a lack of open-skies agreements," Mann says.

Aimed at removing government involvement in commercial air operations, the US has established open-skies agreements with more than 110 countries. That there are none with China is a hurdle for US airlines eyeing expansion.

Unhindered by bilateral agreements, European airlines are showing more enthusiasm for expanding their presence in China, with the majority of new routes to second-tier cities initiated by EU carriers.

US airlines have been pushed to use the more traditional means of access - encouraging partnerships with Chinese airlines. Since 2011, Delta has been using its local partnerships to begin offering direct flights from Beijing to the US. Previously, flights from Beijing stopped at Tokyo's Narita International Airport before traveling on.

"After the merger with Northwest, Delta has been increasing non-stop flights between China and the US without transit at Narita, its Asian hub," says Hiroko Okada, head of Delta corporate communications for Asia-Pacific.

"Shanghai and Beijing now have direct access to the US west and east coasts, with over 130 North America cities available within a one-stop connection.

"Delta's strategy is to grow partnerships with local Chinese airlines and to continue to offer Chinese customers the best travel experience inflight and at the airport."

Delta now code-shares more than 40 routes with Chinese airlines.

With the number of passengers set to steadily rise, Chinese travelers newfound fondness for flight could present big opportunities for international carriers - if they can navigate the turbulence of establishing the right flight paths at the right time.

Contact the writers through toddbalazovic@chinadaily.com.cn

|

Passengers line up to board Finnair's first direct flight from Xi'an to Helsinki on June 15, 2013. Provided to China Daily |

(China Daily European Weekly 01/10/2014 page1) |